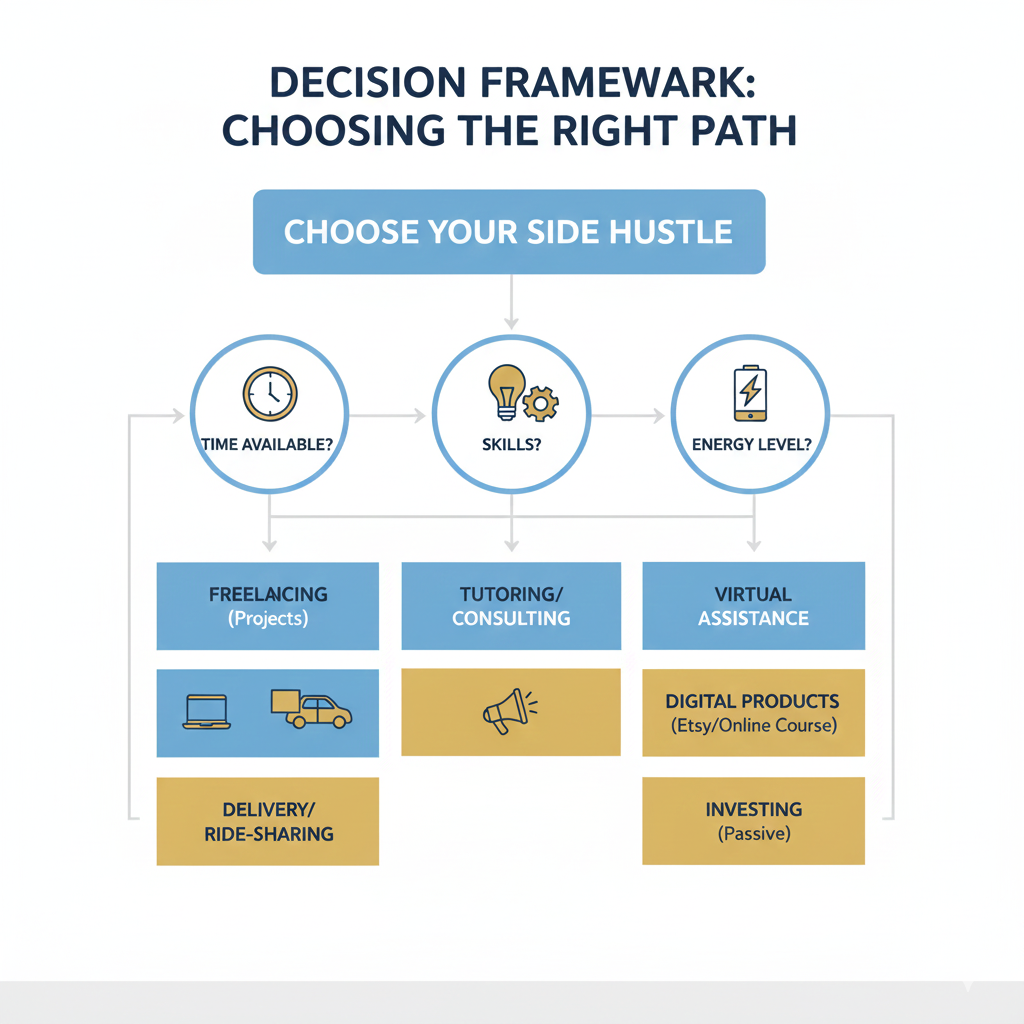

Before looking at specific ways to earn extra income, it is important to pause and choose the right path. I have learned, both personally and through mentoring others, that many people fail not because the option was bad, but because it did not match their current reality.

The first factor to assess is time available per week. Be honest here. Some workers realistically have five to seven hours weekly, while others can manage ten or more. Choosing an option that requires more time than you can give leads to guilt and eventual abandonment. A simple time audit can help clarify this, and resources like this time management guide from MindTools provide practical frameworks:

Next is skills already owned. Extra income becomes easier when it builds on what you already know. Many 9 to 5 workers underestimate the value of their existing experience. Skills from administration, communication, teaching, analysis, or technical work often translate directly into paid opportunities outside the office.

Another key consideration is energy level after work. Some people are mentally sharp in the evenings but physically tired. Others are the opposite. Choosing a side income that matches your energy type reduces burnout and increases consistency.

Finally, consider income urgency. If you need money quickly, skill-based or service options tend to pay faster. If urgency is low, slower-building digital income streams may be a better fit.

This decision-making process reduces overwhelm and increases clarity. Instead of chasing every idea, you choose one aligned path.

With this foundation in place, it becomes much easier to explore specific options that actually fit a 9 to 5 schedule. The next section breaks down skill-based extra income options that many full-time workers can start without quitting their jobs.

SKILL-BASED EXTRA INCOME OPTIONS THAT FIT A 9 TO 5 SCHEDULE

Skill-based income is often the safest starting point for a full-time worker. I usually recommend this path first when mentoring others because it builds on what you already know, pays relatively faster, and does not require reinventing yourself from scratch. The key is choosing skills that fit limited time and post-work energy.

Freelancing After Work

Freelancing simply means offering a specific skill as a service. This can include writing, graphic design, bookkeeping, data analysis, customer support, or even project coordination. For most 9 to 5 workers, five to ten hours per week is enough to get started.

To begin, focus on one service and one platform. Many people fail by trying to offer everything. A common mistake I see is underpricing at the start and attracting difficult clients. It is better to charge fairly and work with fewer people.

Income potential varies, but realistic early earnings often range from small but consistent payments to a meaningful monthly addition once clients stabilize. Platforms like Upwork explain how freelancing works and what to expect as a beginner:

Virtual Assistance

Virtual assistance is a strong option for workers with organizational or communication skills. Tasks may include email management, scheduling, research, or customer follow-ups. The time requirement is flexible, and many roles allow evening or weekend work.

The most common mistake here is saying yes to too many tasks without clear boundaries. From experience, setting defined responsibilities protects your time and mental health.

Income grows as trust builds, and long-term clients often provide stable monthly pay. This overview from HubSpot explains virtual assistance clearly:

Online Tutoring or Coaching

If you have teaching ability or professional knowledge, tutoring or coaching can be a strong fit. This can range from academic subjects to career guidance or software training. Sessions are usually scheduled, which helps with planning around work hours.

The main challenge is preparation time. Many underestimate this and burn out early. Keeping sessions focused and structured helps maintain balance.

Platforms like Tutor.com provide insight into how online tutoring works:

Consulting in Your Current Profession

Consulting allows you to monetize experience gained from your 9 to 5 job. This could involve advising small businesses, startups, or individuals on specific problems you already solve daily.

The mistake many make is positioning themselves too broadly. Consulting works best when you solve one clear problem for a specific audience.

Income potential here is higher, but trust takes time to build. This guide from Harvard Business Review explains consulting fundamentals in a practical way:

Skill-based income works because it respects your time and existing strengths. However, not everyone wants to trade hours for money forever. For those thinking long-term, there are digital income streams that can be built gradually alongside a 9 to 5 job. That is exactly what the next section explores.

ONLINE AND DIGITAL INCOME STREAMS YOU CAN BUILD GRADUALLY

Not every 9 to 5 worker wants to keep exchanging time for money. From my own journey and from watching others grow beyond service-based work, digital income streams appeal because they can scale over time. The trade-off is simple, they usually start slow and require patience.

Blogging for Extra Income

Blogging is one of the most misunderstood digital income options. Many people expect fast results, then quit too early. In reality, blogging works best for those willing to write consistently while learning basic SEO and audience needs. For a full-time worker, a few focused hours per week is enough to make progress.

The most common mistake is writing without direction. Blogging becomes income-focused only when content solves real problems and is monetized intentionally. Google’s own guide on creating helpful content gives a clear foundation for doing this correctly:

Affiliate Marketing

Affiliate marketing allows you to earn commissions by recommending products or services. This often works alongside blogging, email newsletters, or social platforms. The setup is simple, but trust is everything. Recommending tools you do not understand damages credibility.

From experience, sustainable affiliate income comes from education, not promotion. Income is gradual, but once content ranks or audiences grow, it becomes more predictable. This beginner guide from Ahrefs explains affiliate marketing clearly and realistically:

Digital Products

Digital products include ebooks, templates, checklists, or simple guides. These work well for 9 to 5 workers because the creation happens once, and sales can happen repeatedly. The challenge is creating something people actually need.

A mistake I often see is overbuilding. Simple products solve problems faster than complex ones. Income varies widely, but even modest monthly sales add up over time. This Shopify guide breaks down digital products in a practical way:

Content Creation With Monetization

Content creation goes beyond entertainment. Educational content on platforms like YouTube, LinkedIn, or newsletters can lead to ad revenue, sponsorships, or product sales. This path requires consistency and clarity of message.

The biggest challenge is patience. Growth is slow at first, but compounding works in your favor if you stay focused.

Digital income streams reward long-term thinking. They are not quick fixes, but they can reduce dependency on active hours over time. For readers who want options that feel lighter in daily effort, there are also low-effort and passive-leaning income paths worth understanding. That is where the next section leads.

LOW-EFFORT AND PASSIVE-LEANING INCOME OPTIONS

When people hear the phrase passive income, expectations often become unrealistic. From experience and from mentoring others, I have learned that no income is truly effortless. What does exist are options that require more work upfront and less daily involvement over time. For tired or risk-aware 9 to 5 workers, these can be appealing when approached carefully.

Renting Assets

Renting assets means earning from things you already own. This could include property, equipment, or even digital assets like unused storage or tools. The effort is usually concentrated in setup and maintenance, not daily work.

The main mistake here is underestimating management time and risk. Clear agreements and realistic pricing matter. For readers exploring this path, Investopedia offers a solid breakdown of asset-based income:

Automated Digital Products

Automation does not mean no work. It means systems doing repetitive tasks for you. Examples include selling digital downloads with automated delivery or running simple email funnels tied to a product.

From what I have seen, success here depends on clarity. One product solving one problem performs better than many unfocused offers. Income is usually modest at first but can grow steadily. This resource from ConvertKit explains automation in a practical, beginner-friendly way:

Investments With Realistic Expectations

Investing is often mentioned alongside passive income, but it requires education and patience. For a full-time worker, investments are best viewed as long-term wealth builders, not quick income sources.

The biggest mistake is chasing trends without understanding risk. Starting small, learning fundamentals, and focusing on consistency protects both money and peace of mind. This guide from Vanguard explains long-term investing principles clearly:

Low-effort options reduce daily strain, but they still require planning and discipline. Even the best income stream can become overwhelming without proper time control. That is why managing time and avoiding burnout is just as important as choosing the income source itself. The next section focuses on how to balance both effectively.

HOW TO MANAGE TIME AND AVOID BURNOUT WHILE EARNING EXTRA

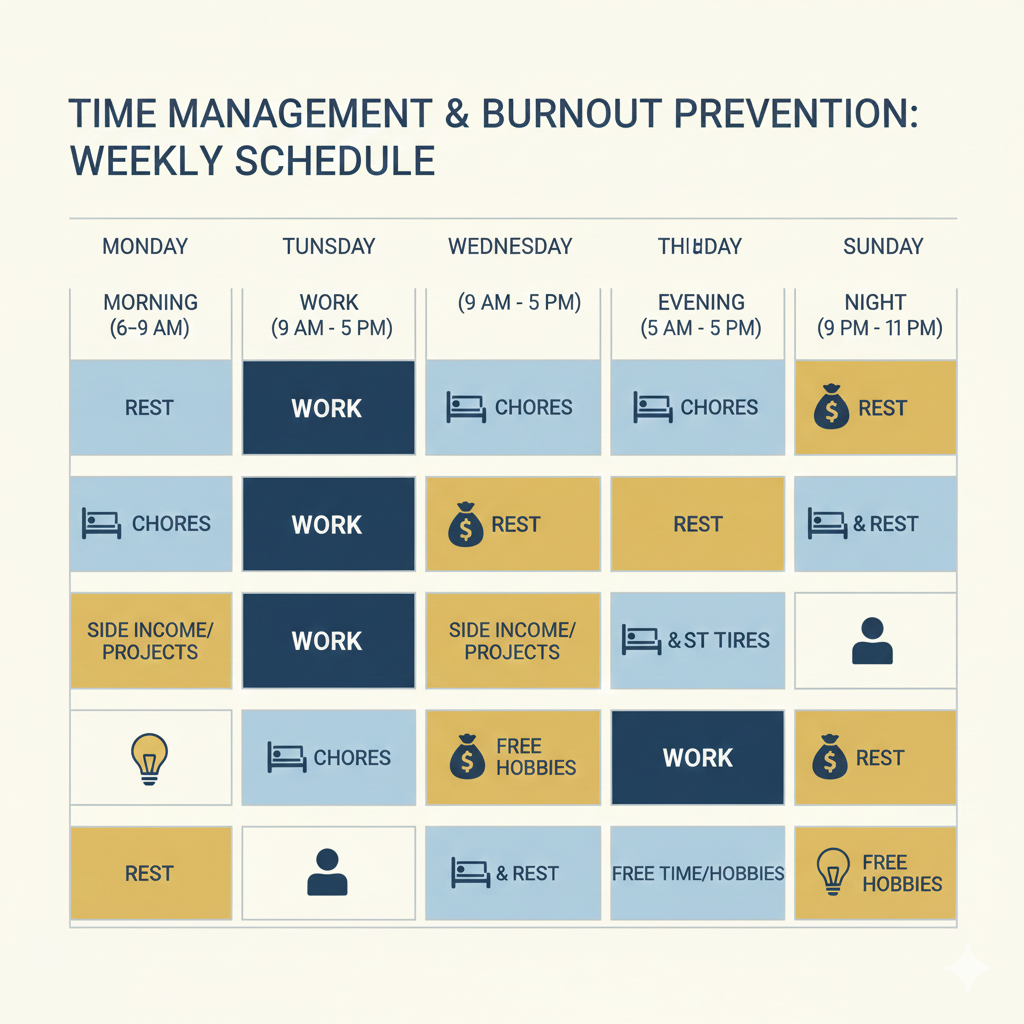

One concern I hear repeatedly from 9 to 5 workers is not whether they can earn extra income, but whether they can survive the process without burning out. From personal experience and from guiding others, I have learned that time management is less about doing more and more about doing what actually fits.

The first strategy is time blocking. Instead of squeezing side work into random moments, assign specific hours during the week. Even two or three focused sessions are more effective than daily exhaustion. This approach reduces decision fatigue and protects personal time. The American Psychological Association highlights how structured routines reduce stress and improve focus:

Setting clear boundaries is equally important. Extra income should never feel like an emergency every night. Communicate limits with clients or platforms early. Saying no to unrealistic demands is not failure, it is sustainability.

Another key habit is avoiding overload. Many people stack too many income activities on top of work, family, and social obligations. From what I have seen, one focused effort beats three scattered ones. Progress comes from consistency, not volume.

It is also important to know when to pause. Rest is not laziness. Short breaks prevent long-term exhaustion. If energy drops sharply, reassessing the workload is wiser than pushing harder.

Managing time and energy properly turns extra income into a support system, not a burden. Once routines are in place, the final step is turning intention into action. A simple, realistic starting plan helps avoid overwhelm, and that is exactly what the next section provides.

REALISTIC 30-DAY ACTION PLAN FOR GETTING STARTED

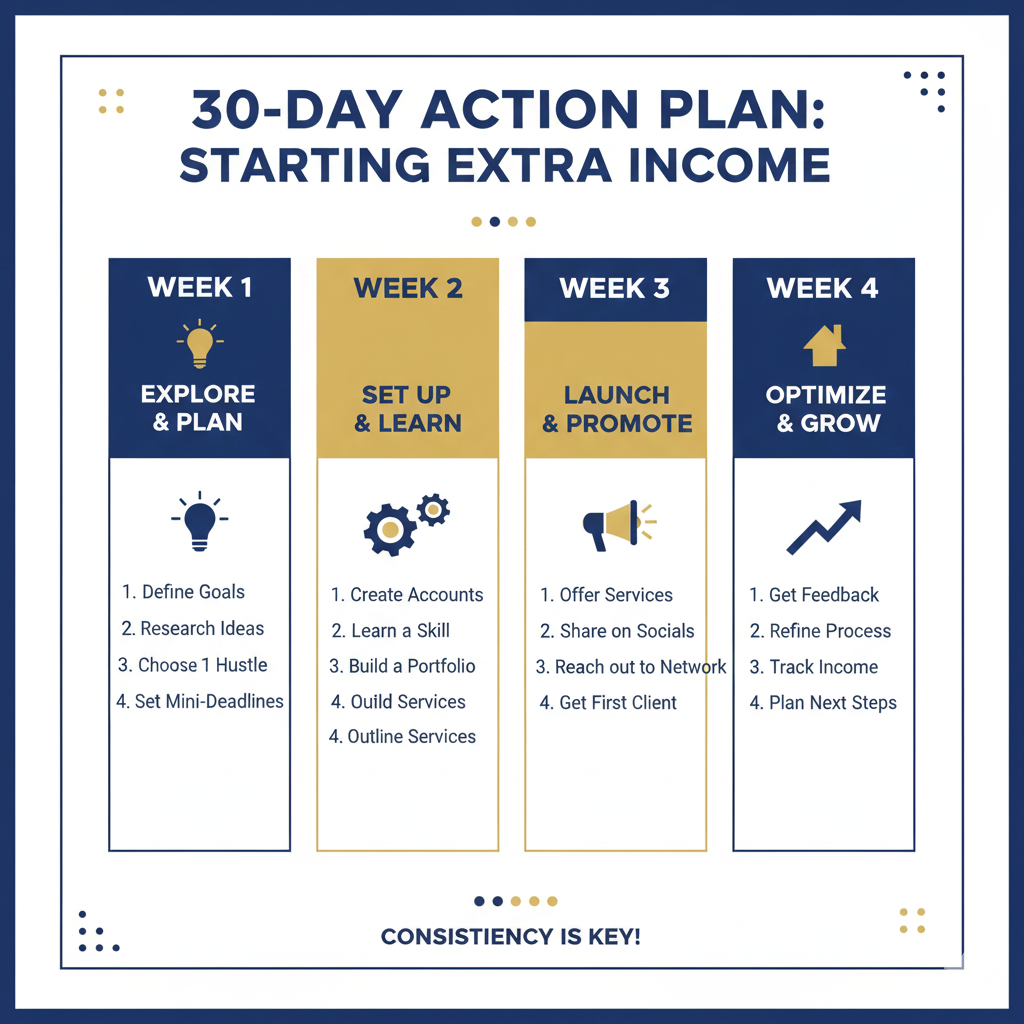

One pattern I have noticed when mentoring 9 to 5 workers is that many understand what to do but delay starting. Too much information creates hesitation. A simple 30-day plan removes pressure and turns intention into movement.

Week 1: Decision and Setup

Use this week to choose one extra income path based on time, skills, and energy. Avoid research overload. The goal is clarity, not perfection. Set up basic tools such as accounts, profiles, or simple outlines. This is also the right time to set boundaries around work hours so expectations are clear from the beginning.

For guidance on goal setting, this resource from MindTools explains how to define realistic objectives:

Week 2: Skill or Platform Onboarding

Focus on learning only what is necessary to start. If it is freelancing, understand how proposals work. If it is blogging or digital products, learn the basics of content creation or setup. The mistake many make here is trying to master everything before acting.

Week 3: First Execution

This is the action week. Send the first proposal, publish the first post, launch the first product, or offer the first service. Confidence grows through doing, not preparation. Small actions matter more than big plans at this stage.

Week 4: Review and Adjustment

Review what worked and what felt heavy. Adjust time blocks, pricing, or focus. Progress is measured by consistency, not perfection.

This 30-day structure creates momentum without pressure. Once action begins, questions naturally arise. Addressing common doubts and fears helps maintain confidence, which is why the next section answers the most frequently asked questions from full-time workers exploring extra income.

FREQUENTLY ASKED QUESTIONS (FAQ)

Can I earn extra income without affecting my main job?

Yes, it is possible when boundaries are clear. Extra income should fit around your work schedule, not compete with it. From experience, problems arise when people overcommit or work during office hours. Keeping side work limited to defined personal time protects both performance and peace of mind. Many employment contracts also include side work clauses, so it is wise to review them. This guide from the U.S. Department of Labor explains general employment considerations:

How much can I realistically make each month?

For most 9 to 5 workers, extra income starts modestly. Early earnings may cover small expenses or add a buffer to savings. With consistency, income can grow, but expecting large amounts immediately often leads to disappointment. Realistic progress compounds over time.

How many hours do I need to commit weekly?

Most sustainable side income paths require five to ten focused hours per week. More hours do not always mean better results. Structured effort matters more than long working nights.

What if I fail at my first side hustle?

Failure is common and often educational. From mentoring others, I have seen early attempts clarify strengths and weaknesses. One failed attempt does not define future success. It usually refines the next choice.

Is it better to learn a new skill or start online immediately?

It depends on urgency and energy. Learning a skill pays off long-term, while online platforms may offer faster exposure. The best option is often the one you can stay consistent with.

CONCLUSION

Earning extra income while working a 9 to 5 job is not about working endlessly or chasing every opportunity online. From experience and from guiding others, progress comes from clarity, patience, and choosing options that respect your time and energy. Extra income should reduce stress, not create a new source of it.

There is no single perfect path. What matters is starting with realistic expectations, focusing on one direction, and allowing growth to happen gradually. Small, consistent steps often lead to more stability than big, rushed decisions.

If you take one thing from this guide, let it be this, extra income is a process, not a shortcut. When approached with intention, it becomes a support system that strengthens your financial position over time.

If you want to go deeper, explore related resources on this site that break down specific income paths in more detail. This platform exists to guide, not pressure, and to help you make decisions that align with your life and long-term goals.

You do not need to rush. You just need to begin, thoughtfully.

You can also check my guide on how to make money online